-

Go to shop

No products in the cart.

Lender Tools

Lender Tools & Resources

Current Mortgage Rates

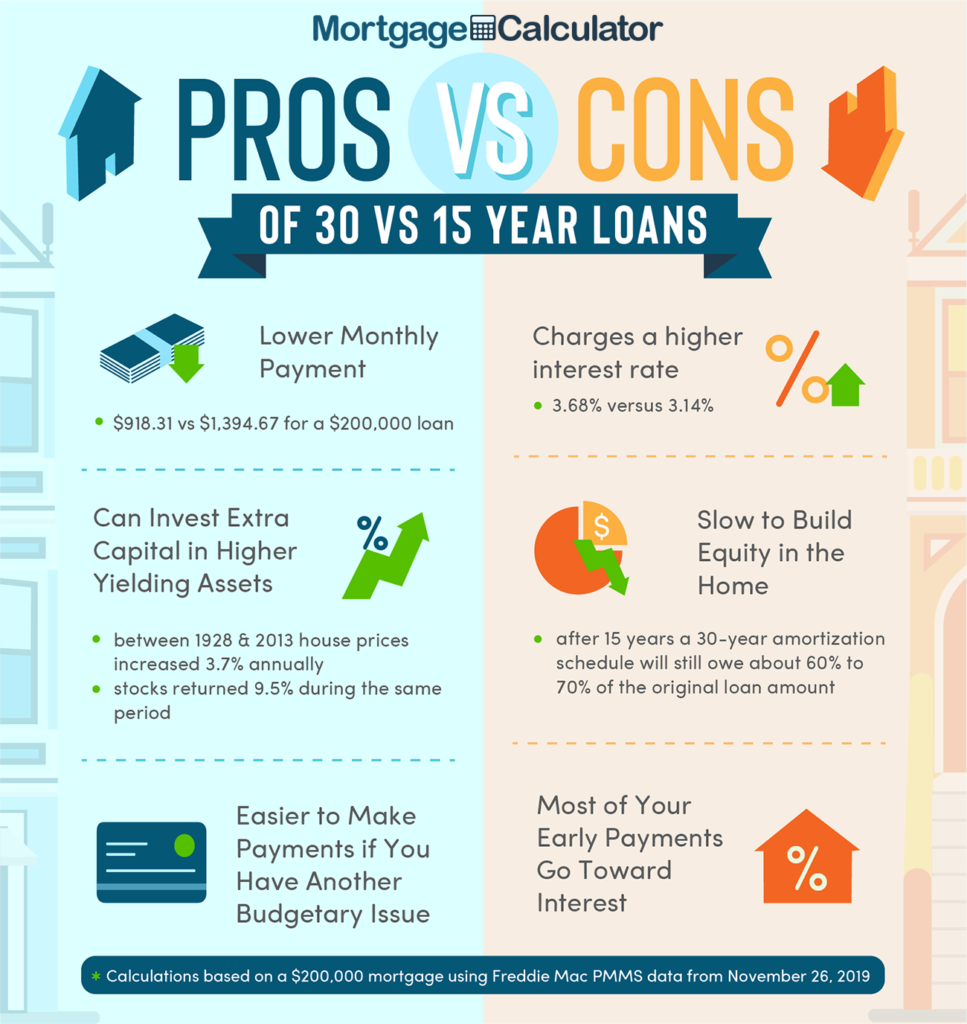

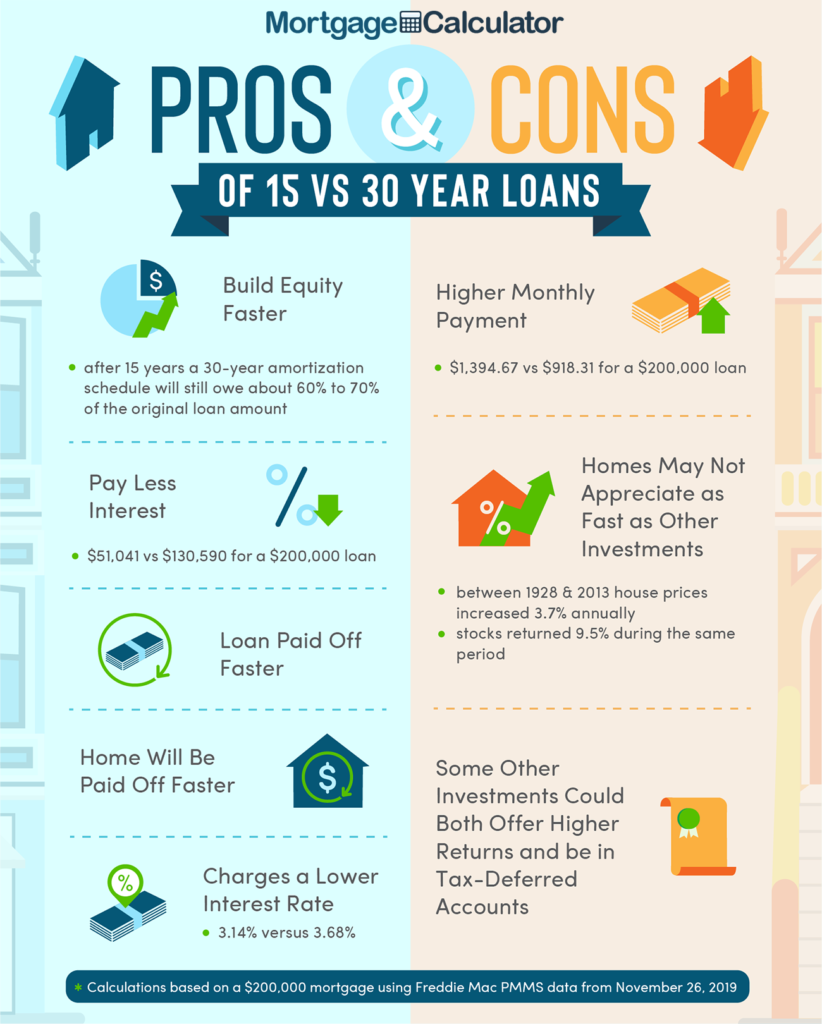

15 Year or 30 Year Guide

Home Loan Requirements

Home Loan Qualification Guide for Realtors and Their Clients

Understanding Home Affordability

Your income is an essential factor in determining the mortgage you qualify for. However, lenders focus more on your income in relation to the home price and your existing debt. Two key ratios help determine affordability:

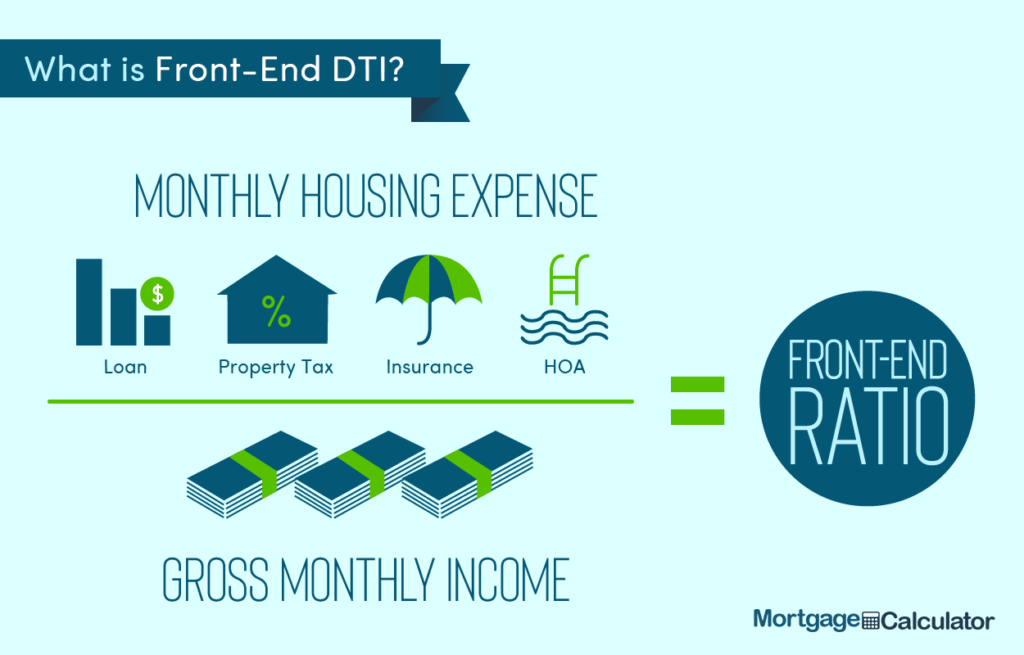

Front-End Ratio (Housing Expense Ratio)

Back-End Ratio (Debt-to-Income Ratio)

Front-End Ratio (Housing Expense Ratio)

The front-end ratio measures the percentage of your gross monthly income allocated to your monthly mortgage payment. Most lenders require that this ratio does not exceed 28% of your gross income. The mortgage payment includes principal, interest, property taxes, homeowner’s insurance, and other necessary fees (PITI – Principal, Interest, Taxes, and Insurance).

Formula:

Front-End Ratio (FER) = PITI / Gross Monthly Income

or

FER = PITI / (Annual Gross Income / 12)

Example:

If your annual income is $90,000:

Multiply by 0.28 → $90,000 x 0.28 = $25,200 (max yearly housing cost)

Divide by 12 → $25,200 / 12 = $2,100 (max monthly mortgage payment)

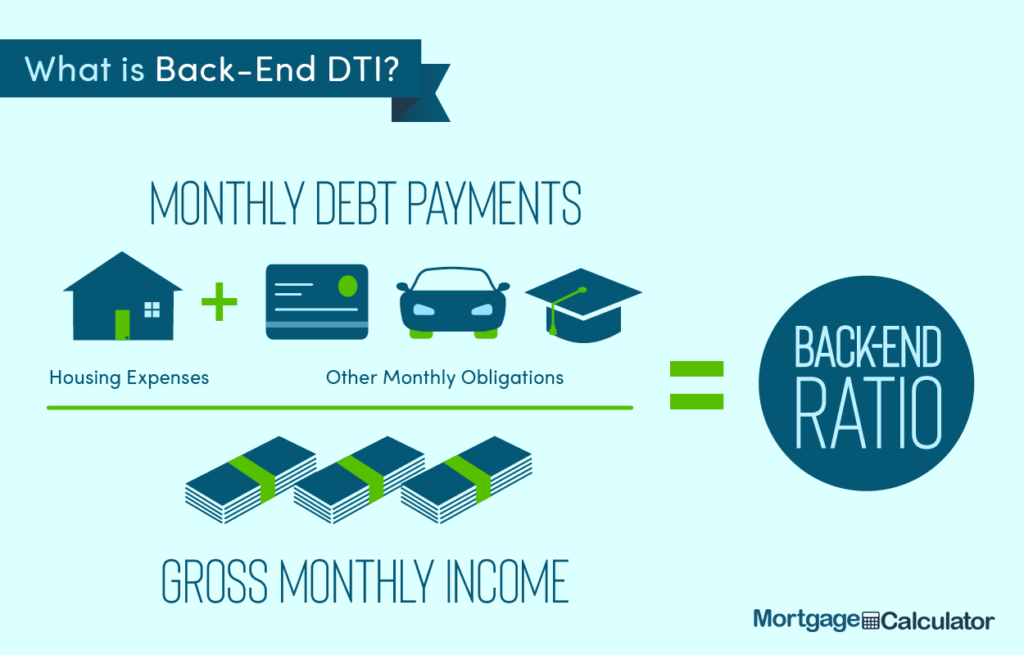

Back-End Ratio (Debt-to-Income Ratio)

The back-end ratio assesses the percentage of your income used to cover all monthly debt obligations, including mortgage, credit cards, car loans, student loans, medical bills, child support, and alimony. Most lenders prefer this ratio not to exceed 36%, though some loan programs allow higher limits.

Formula:

Back-End Ratio (BER) = (PITI + Other Monthly Debt Payments) / Gross Monthly Income

or

BER = (PITI + Other Monthly Debt Payments) / (Annual Gross Income / 12)

Example:

If your annual income is $90,000:

Multiply by 0.36 → $90,000 x 0.36 = $32,400 (max yearly debt limit)

Divide by 12 → $32,400 / 12 = $2,700 (max total monthly debt payments)

If you have $600 in monthly debt payments, the max mortgage payment allowed = $2,700 – $600 = $2,100

Once you know your front-end and back-end ratios, you can use a mortgage calculator to determine the home price range you can afford.

Loan Program Guidelines

Different loan programs have specific criteria for front-end and back-end ratios, down payments, and borrower qualifications. Below is a summary:

| Loan Type | Best For | Front-End DTI | Back-End DTI | Hard Cap | Down Payment | Notes |

|---|---|---|---|---|---|---|

| Baseline | Ideal buyers with strong credit & income | 28% | 36% | None | 20% | Competitive interest rates. PMI required if <20% down. |

| Conventional | Most home buyers | Flexible | 36%-43% | 45%-50% | 3%-20% | Lenders consider multiple factors. Most choose fixed-rate loans. |

| FHA | Buyers with lower credit or smaller down payment | 31% | 43% | 57% | 3.5% | Credit scores 580+ require 3.5% down; scores 500-579 require 10%. |

| VA | Military & veterans | Flexible | 41% | ~47% | 0% | Consideration for BAH & BAS as income. Some cases exceed 41%. |

| USDA | Low-income rural buyers | 29% | 41% | 41% | 0% | Income limit: 115% of local median. Small funding fee applies. |

Next Steps

Assess Your Budget: Use the front-end and back-end ratios to determine how much you can afford.

Improve Debt-to-Income Ratio: Pay down existing debt to qualify for better loan terms.

Consult a Mortgage Professional: Get pre-approved to understand your loan options.

Use a Mortgage Calculator: Factor in property taxes, insurance, and loan term to estimate home affordability.

For more details, speak with your realtor or a trusted mortgage advisor!