-

Go to shop

No products in the cart.

Closing Costs Analysis

Closing Costs Resources

Closing Costs

Understanding Closing Costs Across the U.S.

Closing costs typically range from 2% to 5% of the home’s purchase price, though this is just an estimate. The final amount depends on factors such as the buyer’s loan type, lender fees, and negotiations between the buyer and seller.

Who Pays Closing Costs?

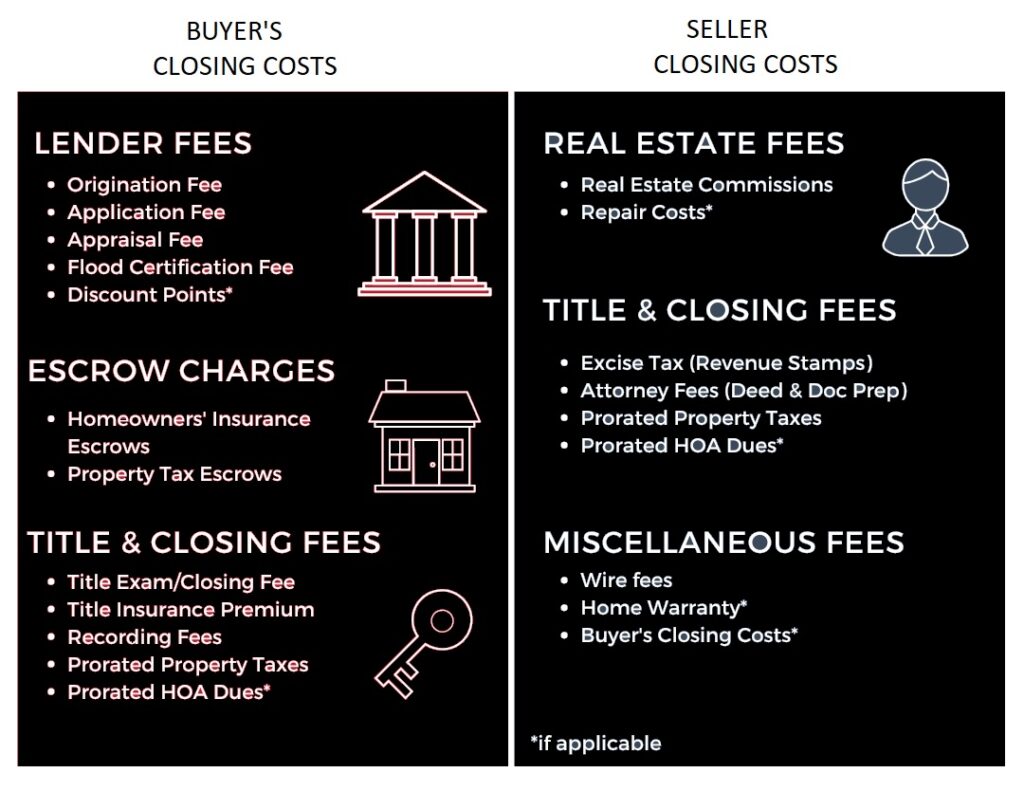

In most areas, both the buyer and seller are responsible for closing costs, but the specific amounts vary. The buyer usually pays most of the closing costs upfront, while the seller’s costs are often deducted from the proceeds of the sale.

Buyer’s Closing Costs Nationwide

For homebuyers, closing costs typically range from 2% to 5% of the purchase price. If you have already paid earnest money (usually between 1% and 3% of the home price), that amount will be deducted from your total closing costs.

Here are common closing costs buyers may face across the U.S.:

- Appraisal Fee: Typically $300 to $600. This is often paid upfront, but if not, it will be added to your closing costs.

- Inspection Fee: Home inspections generally cost $300 to $500, depending on the location and size of the home. This is typically paid at the time of service, but if not, it will be included in your closing costs.

- Loan Origination Fee: Some lenders charge a fee for processing your loan. These fees can vary widely depending on the lender, so it’s important to ask about the specific cost and any potential for negotiation.

- Loan Processing Fee: Lenders may charge this fee for underwriting and other related services.

- Loan Discount Points: If you decide to purchase points to lower your interest rate, expect to pay $1,000 to $3,000 or more per point at closing. Each point typically lowers the interest rate by 0.25% to 0.5%.

- Private Mortgage Insurance (PMI): Required for down payments under 20%, PMI usually appears as a monthly charge but may sometimes be paid upfront. The cost varies by loan type and the size of the down payment.

- Title Insurance: Title insurance protects both you and your lender, with costs typically ranging from $500 to $1,500 or more, depending on the home’s price.

- Homeowners Insurance: Your homeowners insurance premium is often part of your closing costs, with annual premiums ranging from $800 to $2,000, depending on the property’s location and value.

- Homeowners Association (HOA) Dues: If the home is in an HOA-managed community, you may need to pay one month’s dues at closing, typically ranging from $100 to $500 or more.

- Property Taxes: Depending on the location, buyers may need to prepay property taxes as part of their closing costs. The amount varies significantly by state and county.

Seller’s Closing Costs Nationwide

Seller closing costs can vary widely depending on the specifics of the sale, but here are common costs that sellers typically pay:

- Real Estate Agent Commission Fees: These are typically the largest cost for sellers, ranging from 5% to 6% of the home’s sale price. The commission is typically split between the buyer’s and seller’s agents.

- Homeowners Association Fees: Sellers are responsible for any outstanding HOA fees or assessments up to the closing date. If the seller owes any fees, these must be settled before or at closing.

- Property Taxes: Sellers are responsible for paying any outstanding property taxes. If taxes have been prepaid for a period beyond the closing date, sellers may receive a credit for the unused portion.

- Title Insurance: Sellers may be required to pay for the buyer’s owner’s title insurance, which typically costs between $500 and $1,500 based on the sale price of the home.

- Transfer Taxes: In many states and localities, sellers are responsible for paying transfer taxes, which typically range from 0.1% to 2% of the home’s sale price, depending on the state and municipality.

Here’s a closing cost breakdown for a $500,000 home sale nationwide, showing the buyer’s and seller’s estimated costs:

Buyer’s Estimated Closing Costs (Nationwide)

- Appraisal Fee: $300 – $600

- Inspection Fee: $300 – $500

- Loan Origination Fee: $1,000 – $3,000

- Loan Processing Fee: $500 – $1,500

- Loan Discount Points (if applicable): $1,000 – $3,000 per point

- Private Mortgage Insurance (PMI) (if applicable): $1,000 – $2,000

- Title Insurance (Buyer): $500 – $1,500

- Homeowners Insurance: $800 – $2,000

- Homeowners Association (HOA) Dues (if applicable): $100 – $500

- Property Taxes (prorated): $2,000 – $4,000

Estimated Total Buyer Closing Costs (2% to 5%):

- Low Estimate: $10,500

- High Estimate: $25,100

Seller’s Estimated Closing Costs (Nationwide)

- Real Estate Agent Commission: $25,000 – $30,000 (5%-6% of sale price)

- Title Insurance (Seller): $500 – $1,500

- Transfer Taxes (if applicable): $500 – $10,000 (varies by state/locality)

- Homeowners Association Fees (if applicable): Varies

- Property Taxes (prorated): $2,500 – $5,000

- Repairs/Concessions (if negotiated): Varies

Estimated Total Seller Closing Costs:

- Low Estimate: $28,500

- High Estimate: $46,500

Example Summary for $500,000 Sale:

- Buyer Closing Costs (2%-5%): $10,500 – $25,100

- Seller Closing Costs: $28,500 – $46,500

These estimates can vary significantly based on the property’s location, the buyer’s loan type, and any negotiations between the parties. It’s essential to consult with a local real estate agent and lender for more specific figures.

Here is an example of how it looks in a chart in a state like Florida.

Closing Costs Table by Preferred Settlement Services

In real estate transactions, closing costs can become a critical negotiation point between the buyer and the seller. Understanding the nuances of these costs—and how they are distributed—can give you leverage when negotiating on behalf of your client. Here’s a breakdown of how you can approach this from both a buyer’s and a seller’s perspective.

Understanding Closing Costs

Doc Stamps: Documentary stamp taxes (doc stamps) are typically paid by the seller in many states, but this isn’t always set in stone. In Florida, for example, doc stamps are calculated based on the sales price, at a rate of $0.007 per dollar of the transaction price.

Title Insurance: This is often a cost associated with protecting the buyer, but it can also be negotiated. The cost of title insurance is based on state-regulated rates and typically falls to the buyer, but the seller might offer to cover this to make the deal more appealing.

Strategy for Negotiating Costs

Here are some practical strategies for using the Agent Closing Cost Guide in negotiations:

1. For the Seller (Listing Agent):

- Propose Paying for Title Insurance: If you notice that doc stamps (taxes) are a significantly higher cost than title insurance (as in the example where doc stamps are $7,000 and title insurance is $5,750), you can negotiate with the buyer to cover doc stamps while you offer to cover the title insurance.

- Why? This creates a more favorable outcome for your client (the seller), as doc stamps will be more expensive than the title insurance. By proposing to cover the title insurance, you’re helping to minimize your client’s overall closing costs.

- Propose Splitting Costs: If there’s a smaller gap between the doc stamps and title insurance (for example, if doc stamps are $7,000 and title insurance is $6,500), you can suggest splitting the costs equally between the buyer and the seller. This feels fair and keeps both parties invested in the deal.

2. For the Buyer (Buyer’s Agent):

- Negotiate for Seller to Pay Doc Stamps: If the seller traditionally pays doc stamps in your area and the cost of title insurance is lower, you could focus on negotiating for the seller to absorb the doc stamps, leaving the buyer with the smaller cost of title insurance.

- Ask for a Discount: In situations where the costs are negotiable, a buyer’s agent might propose paying a slightly higher purchase price while negotiating that the seller cover more of the closing costs, including doc stamps or title insurance.

3. Propose an Equal Split:

- When Both Parties Are Motivated to Close: If both the buyer and seller are eager to close the deal quickly and have some flexibility with costs, suggest a 50/50 split. This can create goodwill and demonstrate fairness. You could position it as a way to keep both parties satisfied while still being mindful of the financials.

How to Use the Guide in Negotiations

Leverage the “Difference” Column: This column shows the financial disparity between the doc stamps and title insurance costs. If the doc stamps cost significantly more, suggest that the seller cover the title insurance while the buyer covers the doc stamps. This can lead to potential savings for your client without jeopardizing the deal.

Use the “Split” Column for Fairness: The split column can be your go-to reference point if you’re looking to create a balanced and equitable solution. If both parties agree to split the costs, use this as a guideline to propose a fair share for each side.

Example Scenario Recap

- Sales Price: $1,000,000

- Doc Stamps: $7,000

- Title Insurance: $5,750

- Difference: $1,250 (doc stamps are higher)

- Split: $6,375 each (if costs are divided equally)

In this scenario, if the seller covers the title insurance and the buyer covers the doc stamps, the seller is paying slightly less overall. However, if both parties agree to an even split of the costs, the buyer and seller would each pay $6,375.

Conclusion

In every negotiation, being knowledgeable about the costs and leveraging the closing cost guide gives you a significant advantage. Whether you’re representing the buyer or seller, you can create solutions that save your client money while maintaining fairness in the deal. Always educate your clients about these costs so they feel confident in the negotiation process and understand the rationale behind your strategies.